ev charger tax credit 2021 california

The second and larger bill sat within Bidens Build Back Better Act and subsequent increases to the federal tax credit but it couldnt get. Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork.

More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV vehicles including utility discounts on chargers and electricity rates.

. The credit amount will vary based on the capacity of the battery used to power the vehicle. South California Edison SCE is offering its residential customers a 1000 rebate for pre-owned battery electric vehicles BEVs or plug-in hybrid electric vehicles PHEVs. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

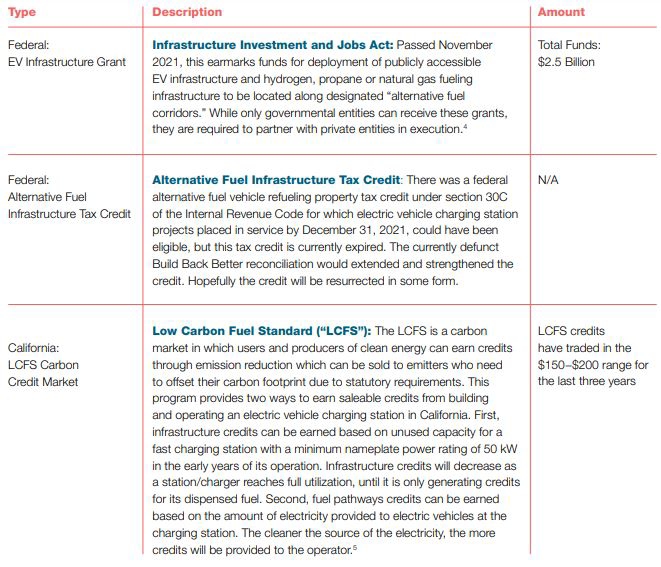

The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs but it expired on December 31 2021. Additional incentives could be available in your ZIP code. After having expired at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back.

The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in California. This incentive covers 30 of the cost with a maximum credit of up to 1000. Just buy and install by December 31 2021 then claim the credit on your federal tax return.

State andor local incentives may also apply. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles Orange. SCE offers a.

The credit is for 30 of the combined cost of the hardware and installation capped at 1000. Technically referred to as the Alternative Fuel Vehicle Refueling Property Credit the Section 30C tax credit will come back into force for charging stations placed in service after December 31 2022. The program was funded through the California Energy Commission and operated from June 1 2015 through March 31 2022.

For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of 30000. Ad Every Month We Help Millions Find the Best Level 2 EV Charger More. Grab IRS form 8911 or use our handy guide to get your credit.

Explore potential EV incentives and tax credits. The expiration of this tax credit shows it does not pay to wait. Compare electric cars maximize EV incentives find the best EV rate.

Theres an EV for Everyone. It is retroactive to January 1 2022. The maximum credit is 1000 per residential electric car charging station and 10000 for each public fueling station.

Explore workplace EV charging incentives. A tax credit is also available for 50 percent of the equipment costs for the purchase and installation of alternative fuel infrastructure. Congress recently passed a retroactive federal tax credit for those who purchased.

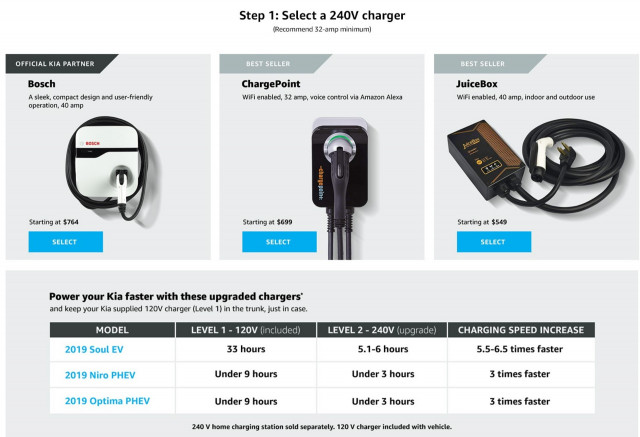

Central Coast Community Energy offers rebates on EV chargers purchased and installed between October 1 2021 and November 15 2022 Glendale Water and Power residential customers can receive up to 599 for installing a home charger. See a list at DriveClean. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

CPCFA Summarizes Sunset of Program. See if you can receive a rebate for installing an EV charger in your home or business. Small neighborhood electric vehicles do not qualify for this credit but.

If you bought a unit earlier this year include it in your tax return. EV Tax Credit Expansion. This has nothing to do with the utility incentives.

The Modesto Irrigation District is offering a rebate of up to 500 on Level 2 electric vehicle charging stations for residential and commercial customers. Up to 1000 Back for Home Charging. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Californias Electric Car Incentives 2021. Applications will be accepted on a first come first served basis until funds are depleted. See how much you could save getting behind the wheel of an EV whether you are buying or leasing.

Over 9000 in California EV rebates and EV tax credits available. Ad Homeowners and businesses who install an EV charger may qualify for rebates and incentives. For non-commercial property the same 30 applies but the credit cap is 1000 and limited to property placed in service at the taxpayers primary home.

This is the same as what it used to be. This EV charger rebate program is a pilot program and has a limited budget. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Tax Credit Calculator Forbes Wheels

Power Play The State Of Electric Vehicle Charging Station Finance Lexology

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Amazon Hooks Kia Owners Up With Easier Home Charger Installation

Southern California Edison Sce Electric Vehicle Incentives And Rebates In 2021 Stellar Solar

Ev Tax Credit Calculator Forbes Wheels

Anaheim Public Utilities Incentives

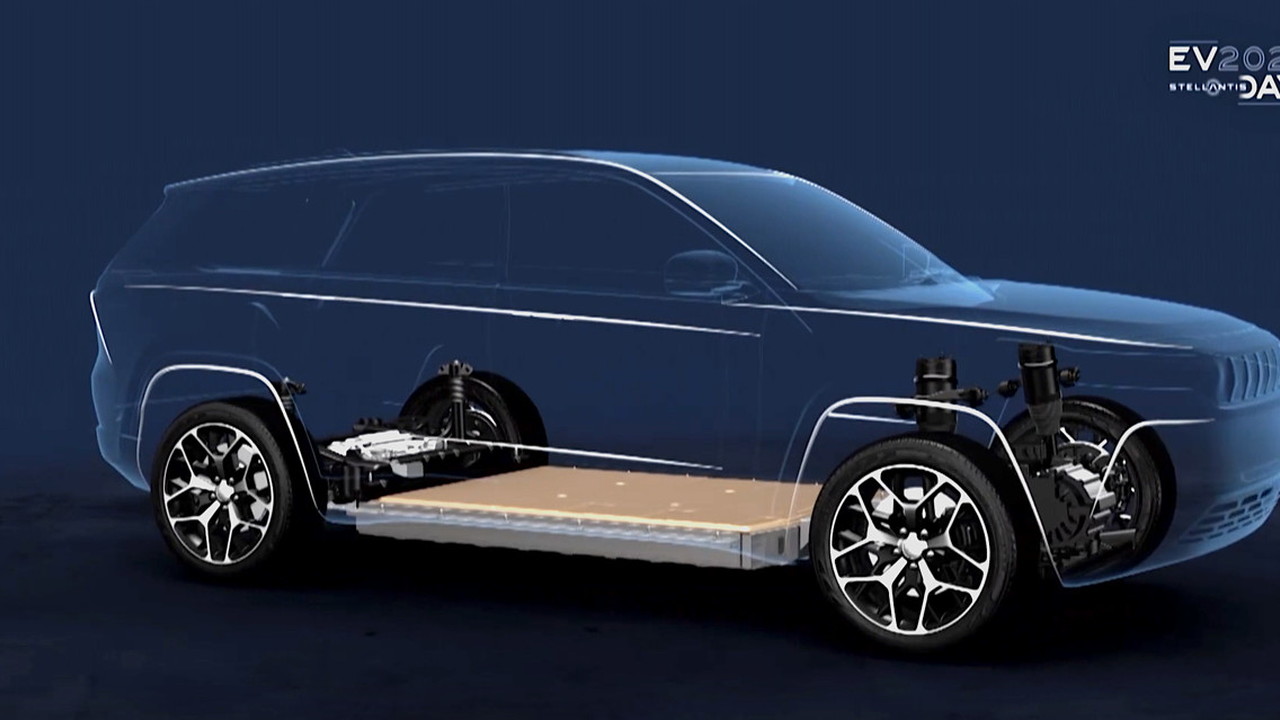

Curbside Ev Charging Polestar And Storedot Stellantis And Samsung Sdi Today S Car News

Electric Vehicle Costs And Incentives

How To Claim An Electric Vehicle Tax Credit Enel X

California Offers Rebates For Installing Ev Charging Stations

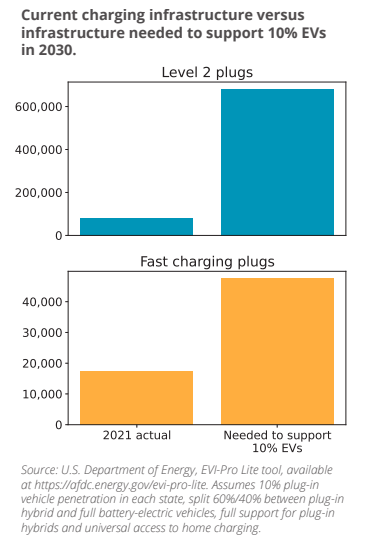

Charged Up For An Electric Vehicle Future Environment America

Rebates And Tax Credits For Electric Vehicle Charging Stations

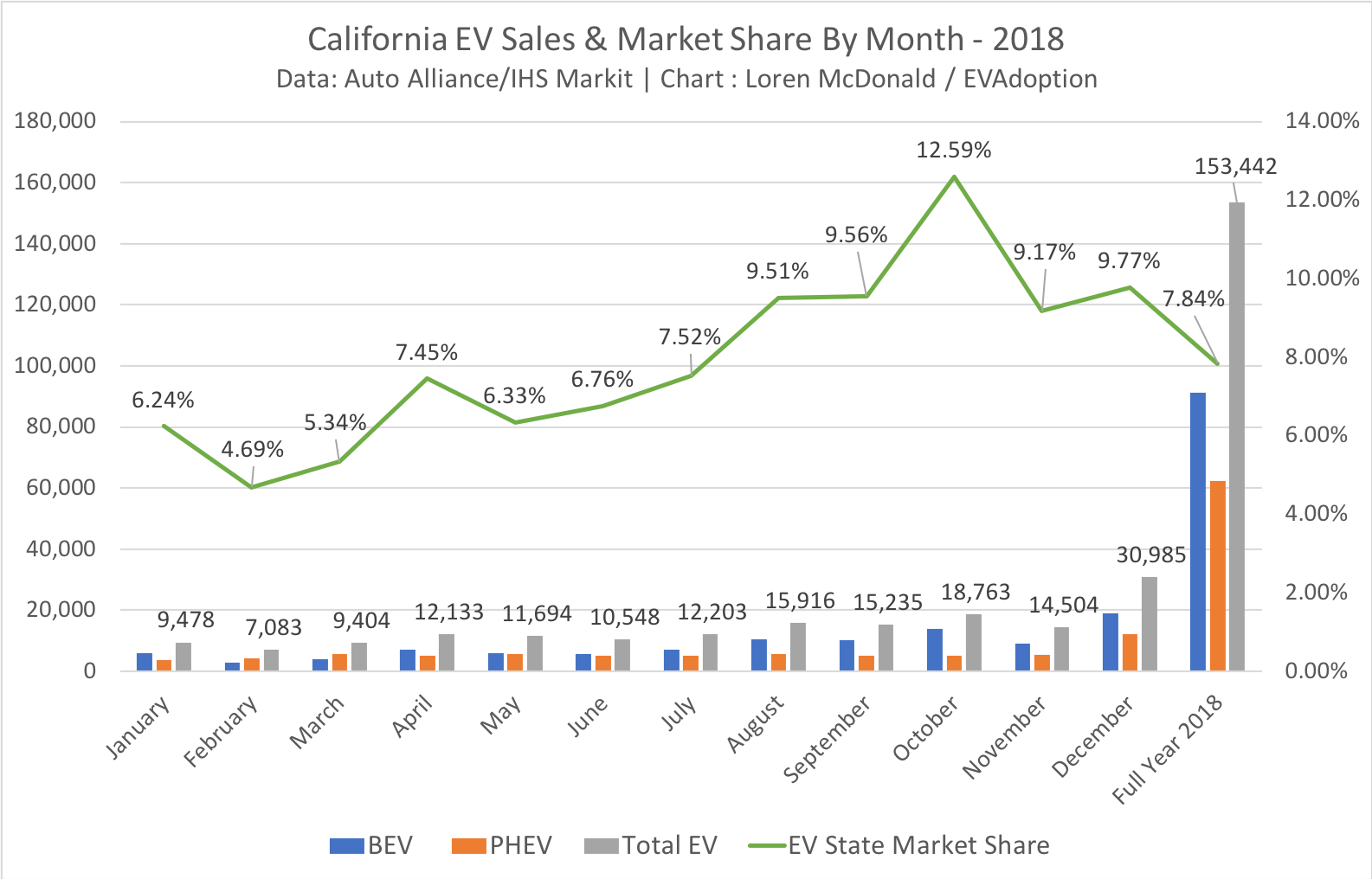

Ev Market Share California Evadoption

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist